Some Known Facts About Dubai Company Expert Services.

Table of ContentsThe Facts About Dubai Company Expert Services RevealedAbout Dubai Company Expert ServicesThe 7-Minute Rule for Dubai Company Expert ServicesThe Of Dubai Company Expert ServicesThe Definitive Guide for Dubai Company Expert Services

As the little young boy said when he obtained off his very first roller-coaster trip, "I like the ups but not the downs!" Below are some of the dangers you run if you wish to start a tiny business: Financial risk. The funds required to start as well as grow a business can be substantial.Time commitment. Individuals usually start companies to ensure that they'll have even more time to spend with their households. Sadly, running a company is incredibly lengthy. Theoretically, you have the liberty to require time off, yet actually, you may not have the ability to obtain away. Actually, you'll possibly have less spare time than you 'd have functioning for somebody else.

6 "The Entrepreneur's Workweek" (Dubai Company Expert Services). Vacations will certainly be hard to take as well as will certainly frequently be disturbed. Over the last few years, the difficulty of obtaining away from the work has been worsened by mobile phone, i, Phones, Internet-connected laptops as well as i, Pads, and many local business owners have pertained to regret that they're always reachable.

Some individuals understand from a very early age they were implied to possess their own business. Others find themselves starting a company due to life adjustments (parent, retired life, shedding a job, and so on). Others might be employed, yet are asking yourself whether the function of service owner/entrepreneur is appropriate for them. There are a number of benefits to starting a company, however there are additionally takes the chance of that need to be assessed.

Our Dubai Company Expert Services PDFs

For others, it might be overcoming the unidentified as well as striking out on their own. You define individual fulfillment, beginning a new company could hold that promise for you. Whether you see starting a company as an economic necessity or a way to make some additional revenue, you might locate it produces a brand-new income.

Have you reviewed the competitors and thought about how your particular company will be successful? Another large choice a tiny service proprietor encounters is whether to have the business directly (sole proprietorship) or to form a separate, legal business entity.

A benefit corporation is for those entrepreneur that want to earn a profit, while also offering a philanthropic or socially useful objective. You can form your organization entity in any kind of state but owners commonly pick: the state where the organization is located, or a state with a recommended governing law.

Ensure the name has words or abbreviations to show the entity type. See to it it doesn't contain any kind of restricted or restricted words or phrases. The entity can be a separate taxed entity, implying it will pay income taxes by itself tax return. Dubai Company Expert Services. The entity can be a pass-through entity, suggesting the entity doesn't pay the tax obligations but its earnings travels through to its owner(s).

The Single Strategy To Use For Dubai Company Expert Services

Sole investors click this site and also companions in a collaboration pay in the region of 20% to 45% earnings tax while business pay corporation tax obligation, usually at 19%. As long as firm tax obligation prices are less than income tax rates the advantage will usually be with a limited business. In addition to wage settlements to staff members, a company can also pay dividends to its investors.

Given a minimal level of salary is taken, the supervisor preserves privilege to particular State benefits with no staff member or company National Insurance policy Contributions being payable. The balance of compensation is in some cases taken as rewards, which may experience less tax obligation than salary and also which are not themselves subject to National Insurance Contributions.

This may be advantageous when the withdrawal of additional revenue this year would take you right into a greater tax obligation bracket. You need to always take specialist tax or financial advice in the light of your details scenarios, and this location is no exception. No advice is used below.

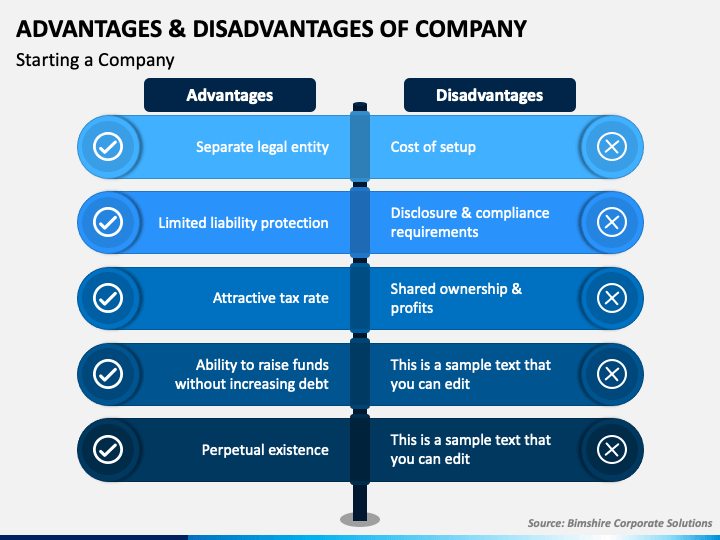

The see post most typical sorts of corporations are C-corps (double exhausted) and also S-corps (not dual tired). Benefits of a firm consist of individual liability security, service protection and also continuity, and much easier access to funding. Negative aspects of a corporation include it being lengthy and also based on double taxes, in addition to having inflexible rules and procedures to adhere to.

See This Report about Dubai Company Expert Services

One choice is to framework as a firm. Although there are a number of reasons incorporating can be useful to your company, there are a few negative aspects to be conscious of as well. To help you identify if a corporation is the most effective lawful framework for your business, we talked with legal professionals to damage down the different kinds of corporations, and also the benefits as well as downsides of incorporating.

For several services, these requirements consist of creating company laws and also filing posts of unification with the secretary of state. Preparing all the info to submit your short articles of unification can take weeks and even months, but as quickly as you've effectively submitted them with your secretary of state, your company is officially recognized as a firm.

Companies are generally controlled by a board of directors chosen by the shareholders."Each proprietor of the company typically owns a percentage of the business based on the number of shares they hold.

A firm provides more individual property responsibility protection to its owners than any type of other entity kind. If a company is filed a claim against, the investors are not personally liable for company financial debts or lawful responsibilities even if the firm does not have enough cash in properties for payment. Personal responsibility security is one of the major reasons businesses pick to integrate.

Dubai Company Expert Services for Beginners

This accessibility to financing is a luxury that entity kinds don't have. It is wonderful not only for expanding a business, however additionally for saving a company from declaring helpful hints bankruptcy in times of requirement. Although some firms (C corporations) go through dual taxes, other company frameworks (S corporations) have tax advantages, depending upon just how their income is distributed.

Any income marked as owner wage will certainly be subject to self-employment tax, whereas the remainder of business rewards will certainly be strained at its very own degree (no self-employment tax). A firm is except every person, and also it can wind up costing you even more money and time than it deserves. Before ending up being a corporation, you should recognize these potential downsides: There is a lengthy application procedure, you have to adhere to inflexible procedures and also procedures, it can be pricey, and also you might be double exhausted (depending upon your firm framework).

There are numerous types of companies, consisting of C companies, S firms, B corporations, shut corporations and also nonprofit companies. Some alternatives to firms are sole proprietorships, collaborations, LLCs and cooperatives. (C-corp) can have an endless number of shareholders as well as is strained on its income as a separate entity.

Comments on “Dubai Company Expert Services Things To Know Before You Get This”